“Jerry, just remember…it’s not a lie, if you believe it.”

– George Costanza

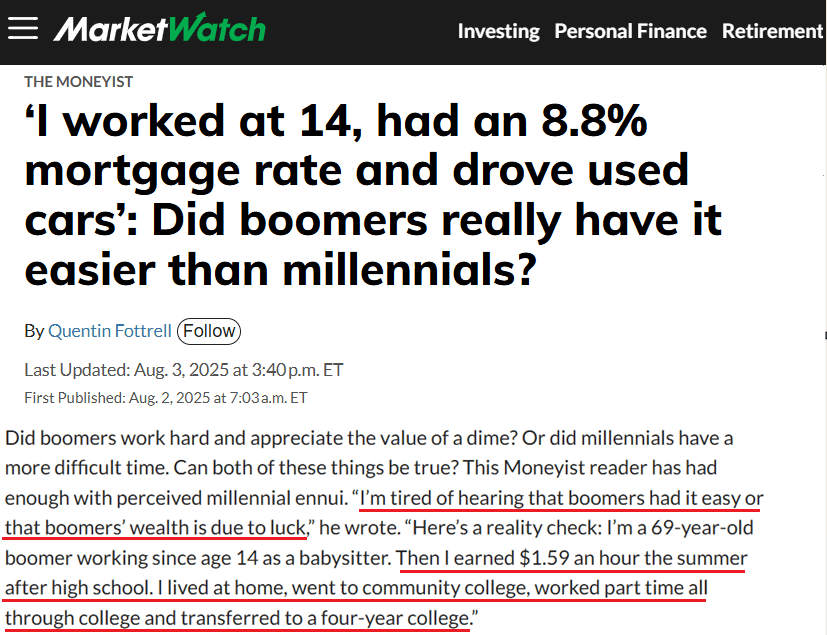

If you’re struggling to articulate why and how public discourse has derailed the way it has in recent years, look no further than one of the greatest fictional characters of the 90’s, one George Louis Costanza.

For those who don’t recall the above quote (or those too young to even know the show Seinfeld even existed), Jerry lied to his girlfriend saying he’d never seen Melrose Place. He doubled down enough that he talked his way into taking a lie detector test, which he was going to fail because he was secretly a Melrose Place superfan. Rather than just confessing (“It’s too stupid to confess! Look what I’m confessing to!”) he enlists the help of his friend George, one the most “deceitful, duplicitous, deceptive minds of our time”. The above line is the parting advice George had for Jerry: to beat the lie detector test, he had to gaslight himself into believing he had never seen a show he religiously watched every week.

Whether or not it was “true” didn’t matter. What mattered was twisting the truth enough to believe it was not real, at least for long enough to beat the lie detector.

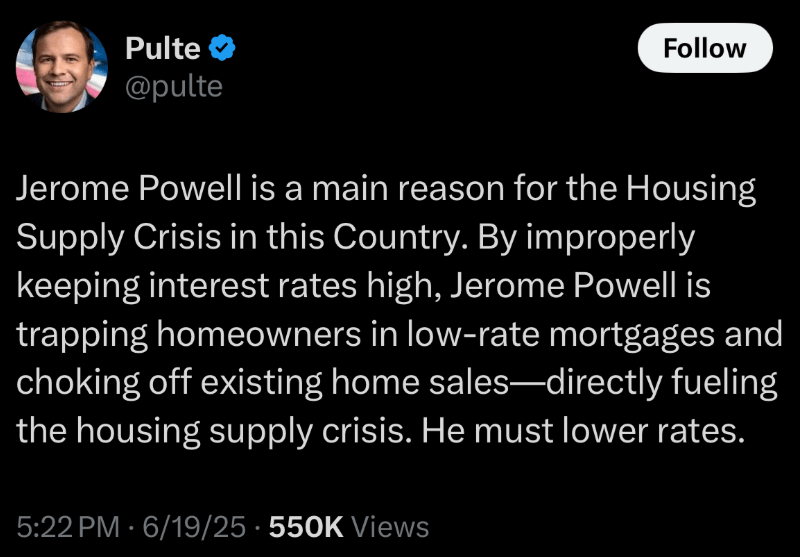

This tactic seems to have gone mainstream, but I’m not going to gab about every area in which this is prevalent. I’m not here to make you cry amigos, I’m here to tell bad jokes and stick to my very narrow focus of housing, interest rates & mortgages. With that, today the blog’s focus is on Bill Pulte – the newly appointed head of Fannie Mae and Freddie Mac, 37 year old heir to the Pulte Homes fortune, and evidently a George Costanza acolyte.

Here’s the crusade Pulte is on these days:

He says this over, and over, and over again. There’s just one problem: that’s not how mortgage rates work, and cutting the Fed Funds Rate can potentially lead to higher mortgage rates. Want proof? Here’s what happened when the Fed cut interest rates by a total of 1% between September and December of 2024.

We’ll get to what happened in the chart above in a minute. But as far as mortgage rates are concerned, to put it in an overly simplified way, regardless of what the Fed does:

- Inflation, strong labor market, growing economy = mortgage rates tend to stay elevated

- Disinflation, weakening labor market, slowing economy = mortgage rates tend to fall

The Fed tends to follow this general blueprint. If the economy is running hot, they raise interest rates to curb inflation. If the economy is slowing, they cut rates to juice economic activity. Because they typically follow the same blueprint, the direction of the Fed Funds Rate and long term rates (like mortgages) historically move in similar directions.

What happened in the chart above was the Fed cut their rates when inflation was softening, only to be surprised by a stronger than expected jobs report, showing a resilient economy even after years of higher rates. Even though the Fed cut their rates, the economic data that followed didn’t support mortgage rates following suit. Not only did the Fed cut not matter, but mortgage rates ended up increasing. That’s because cutting rates in a strong economy could mean juicing an economy that doesn’t need to be juiced…which could stoke inflation fears and increase the demand for yield on long term bonds like mortgages.

If you even casually follow the administration’s economic policies and their talking points about the economy they’re creating, you can start to see the potential issue here, if they’re sincere in wanting the Fed to cut rates…

Tariffs (and the uncertainty around them) and the spending bill (which is projected to add trillions to the national deficit) could reignite inflation expectations. The economy is “hot” (Speaker of the House Mike Johnson’s words), the labor market is “booming” (Press Secretary Karoline Leavitt’s words), we’re entering a “Golden age that will unleash the American economy” (Secretary of Treasury Scott Bessent’s words), and asset prices are at all time highs. So, if the economy is doing so well, then what’s the justification in cutting the Fed Funds Rate?

Absent any economic data that supports cuts in this environment, the bond market likely won’t be fans of the Fed being strong-armed into cutting their Fed Funds Rate, and there’s a decent chance that mortgage rates would increase again if they cut prematurely. Want proof? Here’s what happened to interest rates on July 16th, when it was widely reported that Trump was on the verge of firing Jerome Powell as Fed Chairman:

BLUE LINE: long term rates spiking because of the expectation that short term rates would fall even though economic data doesn’t support it, which could heat up an economy that’s already running hot.

Source: Matt Graham, MBS Live

IN SUMMARY:

- If you want the Fed to cut the Fed Funds Rate, make a valid argument (even though I don’t know if I agree with him at the moment, shoutout to Fed Board Member Christopher Waller for at least articulating an argument for a cut using available economic data);

- Cutting the Fed Funds Rate probably doesn’t improve mortgage rates or home affordability on its own…you’d need economic data to support lower long term rates;

- None of this has stopped Bill Pulte from beating the drum of “the Fed needing to cut mortgage rates” and he should know better…but ya know…refer back to the opening quote of this post;

- And finally…since I know you just have to know…Jerry’s passion for Melrose Place ended up outweighing his desire to beat the lie detector test